Workplace pension salary sacrifice

A cost-effective way for both employers and employees to save on National Insurance and income taxWhat is salary sacrifice?

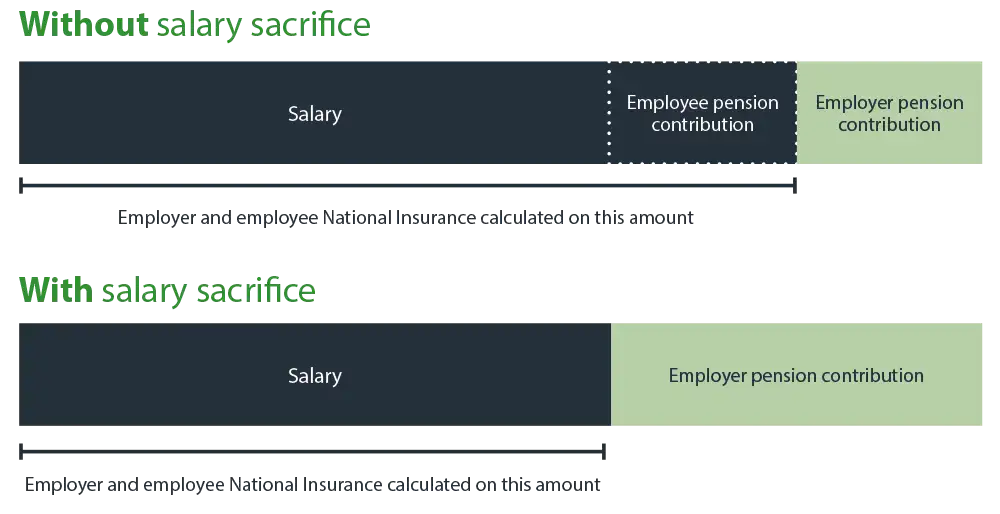

Pension salary sacrifice (sometimes referred to as salary exchange) is a method used to pay pension contributions. It allows an employee to sacrifice part of their salary for an equivalent increase in the contribution their employer makes to their workplace pension. This is commonly more cost-effective than the Relief at Source method, which takes pension contributions from an employee’s net pay.

The benefits for your people

Salary sacrifice technically reduces the amount of pay an employee receives. However, this lowers their tax and National Insurance contributions, which are both calculated on this post-sacrifice amount. This therefore means an increase in take-home pay compared to making pension contributions via the Relief at Source method.

Martin Parish

Regional Director - Employee Benefits

Strengthening your pension strategy to better support your workforce’s future

A four-part webinar series exploring the key elements of your pension strategy to help you deliver a better return on investment for your business and better retirement outcomes for your people

The benefits for your business

Salary sacrifice saves you National Insurance on the amounts your employees pay into their pension plans, equivalent to 15% (from the 2025/26 tax year). In addition, employees will save National Insurance at their applicable rate, either 8% or 2% depending upon their level of salary.

Claire Gibson DipFA Assoc CIPD MLIBF

Senior Employee Benefits Consultant

Download our employer's guide to salary sacrifice

In our employers guide to salary sacrifice, we clarify the key aspects of offering salary sacrifice to your employees. We explain how salary sacrifice works and the potential benefits, so that you can decide whether it is right thing for your business and your people.

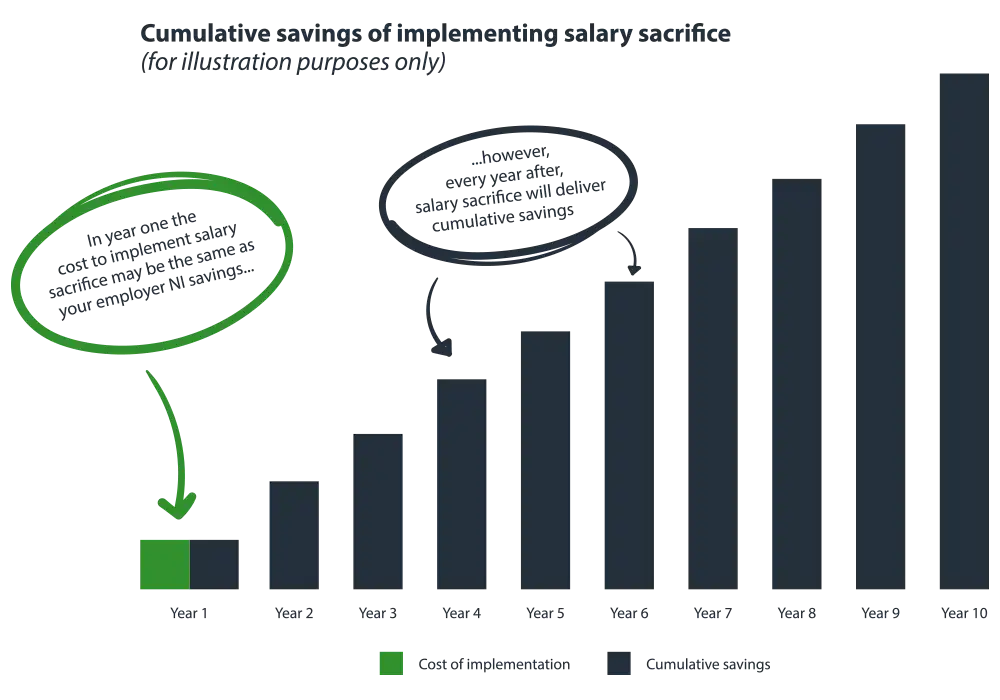

Justifying the cost of implementing salary sacrifice

The initial cost of implementation will generally mean that savings in the first year of pension salary sacrifice are going to be lower, which can deter some businesses. However, when you take into account the cumulative saving, all from that one initial implementation fee, the potential value of salary sacrifice becomes clear even for smaller businesses.

How salary sacrifice works for your people

- Employee signs an agreement confirming their consent to sacrifice salary in return for an equivalent pension contributions.

- Gross pay reduces by the amount sacrificed.

- Tax & NI contributions are not payable on the amount sacrificed, so the total amount of deductions reduces.

- Take home pay increases compared to making pensions contributions with post-tax pay.

- Employer pension contribution is increased by the amount sacrificed, so there is no impact on the level of pension benefits.

How salary sacrifice works for your business

- Employer reduces gross pay by the amount requested to be sacrificed.

- The employer pension contribution is increased by an equivalent amount, so the same total amount is paid into the employee’s pension.

- A reference salary of the pre-sacrifice amount is recorded and used for all pay-related issues.

- The amount of employer National Insurance paid is reduced due to the reduction in an employee’s gross pay (subject to Class 1A NI contributions).

- Employer benefits from a 15% saving of any amount sacrificed.

Here to simplify the process for you

We understand how much time, resource and expertise it takes to implement an effective salary sacrifice process. NFP offer a fully managed salary sacrifice implementation process where an NFP consultant will:

- Oversee your project from start to finish

- Act as the main conduit between all relevant stakeholders

- Ensure that all the relevant requirements of a successful implementation are delivered

Adam Burn

Head of Pensions Consulting

Request a chat with one of our salary sacrifice specialists

To discuss how pension salary sacrifice can save your business and people money, all while helping you deliver the same great pension outcomes, request a call back from one of our specialists.